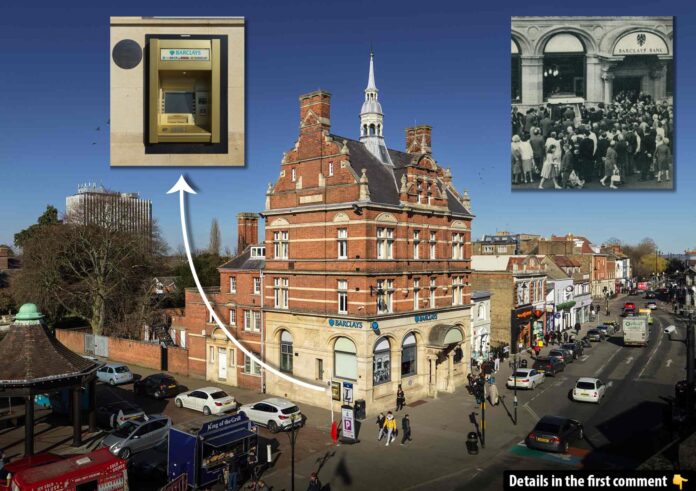

In 1967, a quiet corner of Enfield, North London, witnessed an event that would revolutionize global banking—the installation of the world’s first ATM. Within the striking red-brick Barclays Bank building, a groundbreaking invention transformed how people accessed cash. Behind this historic milestone lies a fascinating story of innovation, ambition, and an unexpected celebrity cameo!

The Birthplace of Automated Banking

Barclays Bank in Enfield wasn’t chosen at random for this world-first innovation. The decision stemmed from its strategic location, with good pavement access, a diverse mix of customers, and proximity to Barclays’ head office. The launch of the ATM introduced a novel concept to the public: a machine capable of dispensing cash without the need for a bank teller. The inaugural moment featured Reg Varney, a well-known British comedian at the time, who performed the first transaction by withdrawing £10 using a specially designed paper voucher. While the choice of Reg Varney may seem unconventional, his local connection to Enfield and popularity added a relatable charm to the event.

Discover the history behind the world’s first ATM in this BBC London News video – watch to learn how this invention revolutionized banking and changed the way we handle money!

Architectural Splendor of Barclays Bank, Enfield

The Enfield branch of Barclays Bank is as notable for its architectural elegance as it is for its technological significance. Built in 1897 by architect William Gilbee Scott, the building features a distinctive “exuberant Flemish Renaissance” style, characterized by its striking red brick façade, stone dressings, and prominent gables.

Topped with a decorative cupola and a small spire, the structure stands out as a masterpiece of late 19th-century commercial architecture. Its ground floor, constructed from stone, adds a sense of grandeur, while its high windows provided practical benefits for the ATM installation. The building’s unaltered exterior and historical significance earned it a Grade II listing in 2023, ensuring its preservation for future generations.

The Early Days of ATMs

Unlike today’s sleek, card-operated machines, the first ATM was a prototype that operated using paper vouchers resembling cheques. Customers had to insert these vouchers, pre-punched with dots corresponding to a four-digit PIN. Authentication required both a matching signature and PIN, and once verified, the machine dispensed a single £10 note. While this may seem rudimentary by modern standards, it was a monumental leap forward in banking technology. Enfield’s ATM was one of six prototypes, with others installed in locations such as Hove, Ipswich, and Luton later that year.

The choice of Enfield for this pioneering endeavor reflected its “model cross-section community,” though the exact reasoning behind this term remains unclear. What is certain, however, is that the quiet suburban location provided a controlled environment to test this groundbreaking technology before its broader rollout.

Cultural Impact of the First ATM

The introduction of the ATM in Enfield marked a significant shift in public perception of banking. Suddenly, access to cash was no longer confined to strict banking hours or long queues inside branches. This newfound convenience resonated with customers, and the success of the prototype machines paved the way for a rapid expansion. By 1969, there were already 34 ATMs within a 15-mile radius of London’s Marble Arch. Today, there are over three million ATMs worldwide, demonstrating the enduring impact of this innovation.

In 2017, to commemorate the 50th anniversary of the first ATM, Barclays unveiled a gold-painted cash machine at the Enfield branch. A new commemorative plaque was also installed, celebrating the legacy of this technological breakthrough.

Preservation and Recognition of Heritage

The Grade II listing of Barclays Bank in 2023 highlights the dual significance of the building: as an architectural gem and as the birthplace of a global banking innovation. The listing ensures that the building will remain protected, preserving its historical integrity and architectural beauty. According to Sarah Gibson, Listing Team Leader at Historic England, the recognition serves as a reminder of how far banking practices have evolved since 1967, even as the importance of cash continues to decline in the era of contactless payments.

Enfield: A Model Cross-Section Community

Enfield’s selection as the launch site for the first ATM was driven by practical considerations, such as its accessible layout and diverse customer base. However, it also symbolized the adaptability and forward-thinking spirit of the community. The success of the ATM in Enfield proved that such innovations could seamlessly integrate into everyday life, paving the way for widespread adoption.

The ATM Legacy in Modern Banking

The invention of the ATM revolutionized banking, making it more accessible and customer-centric. Over the decades, advancements such as debit cards, chip-and-pin technology, and contactless payments have further transformed how we manage our finances. While the use of physical cash has declined in favor of digital transactions, ATMs remain a vital resource for many, particularly in communities with limited access to banking services.

Ironically, the very success of the ATM has contributed to its potential obsolescence. As cashless technology dominates, the need for ATMs is dwindling. Yet their historical significance and the convenience they introduced to millions of lives cannot be understated.

Video

Explore the fascinating history behind the creation of the ATM – watch the video to learn how this revolutionary invention transformed banking and made cash more accessible!

Conclusion

The Barclays Bank in Enfield stands as a symbol of ingenuity and progress. From its striking Flemish Renaissance design to its role as the site of the world’s first ATM, the building embodies a unique blend of architectural beauty and technological innovation. Its Grade II listing ensures that this piece of heritage will be preserved, serving as a reminder of the transformative power of creativity and forward thinking.

In a world where banking has moved increasingly online, the story of the Enfield ATM offers a nostalgic look back at a time when accessing cash felt like a marvel of modern technology. As we navigate the future of financial services, the legacy of that humble £10 withdrawal in 1967 continues to inspire and remind us of the possibilities of innovation.